1 On 5 July 2019 the Malaysian Inland Revenue Board the IRB released guidelines the Guidelines to supplement the Rules. Company that provides loan or advances to directors from its internal funds shall be deemed to derived interest income which is assessable under Section 4 c of Income Tax Act 1967 ITA.

Energies Free Full Text Electric Vehicles In Malaysia And Indonesia Opportunities And Challenges Html

Year of Assessment 2014 Year of Assessment 2015 Year of Assessment 2016 Interest - RM2000 Payable for 112014 to 31122014 but only due to be paid on 31122016.

. Loans to directors are interest-free. 112 x A x B. Direct interest vs deemed interest - Free ACCA CIMA online courses from OpenTuition Free Notes Lectures Tests and Forums for ACCA and CIMA exams.

Im from Malaysia November 17 2018 at 716 am 485054. Resident individuals Chargeable income RM YA 20182019 Tax RM on excess 5000 0 1. Effective from 2 January 2015 the Base Rate replaced the Base Lending Rate as the main reference rate for new retail floating rate loans.

This page includes a chart with historical data for Deposit Interest Rate in Malaysia. Https Mpra Ub Uni Muenchen De 87576 1 Mpra Paper 87576 Pdf. The interest income for that basis period shall be the aggregate sum of monthly interest in that basis period.

Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share capital of MYR 25 million and below at the beginning of the basis period for a year of assessment. On 28 June 2019 Malaysia issued rules the Rules on the interest deductibility limitation. The interest income is calculated based on the formula -.

The sum of the monthly interest is determined. Director Deemed Interest Rate Malaysia 2018 - Base Lending Rate Rates Maybank Malaysia. Interest Rates Volumes.

Of director and not from his employment in an executive or management position. Interest 15 Royalty 10 Special classes. Rate of Interest Loan Period Date the Loan and Interest is Due to be Paid 5 non- cumulative 3 years 31122016 Interest payable for each year of assessment is as follows.

A is the total amount of loan or advances outstanding at the end of the calendar month. It sets out the interpretation of the Director General in respect of the particular tax law and the policy as well as the procedure applicable to it. Interest Rates Volumes - Bank Negara Malaysia.

Total loans made to directors are RM300000. Home Directory Market Market Overview Market Screener Market Map Exchange Rates Login Register 4453754400. BI 51 - 57indd 173 102117 138 AM.

CAHPL did not provide security for the loan and CFC did not provide a loan guarantee. Total Deemed Interest held pursuant to Section 8 of the Companies Act 2016- Deemed Interest No of Shares ----- ----- Dynamic Milestone Sdn Bhd 161401000 Podium Success Sdn Bhd 1950000. Corporate tax rates for companies resident in Malaysia is 24.

Youll find that theres a diagram representing the situation where a director holds a deemed interest. These rules and guidelines follow the proposal of the limitation in the 2019 budget 2 released on 2 November 2018 and enacted. If the company charges interest of 3 on the director advance the total interest payable by the director is RM245000 which is less than the deemed interest of RM408333.

9 1 See Directors Conflict of Interest in Lee Hishammuddin Allen Gledhills Legal Herald June 2018 issue p 21 2 Wong See Yaw Anor v Bright Packaging Industry Bhd 2016 6 CLJ 465 3 Adoption of constitution is now not mandatory for a private company. Malaysia Taxation and Investment 2018 Updated April. The interest income for the basis period for a.

Deposit Interest Rate In Malaysia 1980 2019 Data 2020 2021 Forecast Historical. The Director General may withdraw this Public Ruling either wholly or in part by notice of withdrawal or by publication of a new Public Ruling. Also deemed derived from Malaysia wef the.

The IRBM also issued PR82015 on Loan or Advances to Director by a Company to explain on the tax treatment of interest income deemed to be received by the company from the loans or advances to directors of the company without interest or with interest rate lower than the arms length rate. In this scenario the interest income to be disclosed as earned in the tax return is RM735000. Revenue Board of Malaysia.

Deposit Interest Rate in Malaysia decreased to 156 percent in 2021 from 196 percent in 2020. Is The Negative Interest Rate Policy Effective Sciencedirect. Co a member firm of the malaysian institute of accountants was established in 1999.

Deemed Interest Rate Malaysia 2018 Get link. Billion at an interest rate of approximately 9 from CFC. 20182019 Malaysian Tax Booklet 22 Rates of tax 1.

CFC had raised the money which it lent to CAHPL by issuing commercial papers in the US at an interest rate of 12. 33 Taxable income and rates 34 Capital gains taxation 35 Double taxation relief 36 Anti-avoidance rules 37 Administration 40 Withholding taxes 41 Dividends 42 Interest 43 Royalties 44 Branch remittance tax 45 Wage taxsocial security contributions 46 Other withholding taxes. Interest Rate in Malaysia is expected to be 175 percent by the end of this quarter according to Trading Economics global macro models and analysts expectations.

In this case no interest income is deemed to be received by J Sdn Bhd because the loans are from external funds. Deposit Interest Rate in Malaysia averaged 475 percent from 1980 until 2021 reaching an all time high of 975 percent in 1982 and a record low of 156 percent in 2021. J Sdn Bhd has obtained a bank loan of RM2 million with interest at 4 per annum.

The loan is for purposes of business and also loans to directors. There were also no financial or operational. Effective from YA 2014 it is proposed that a Company is deemed to have gross income consisting of interest from loan or advances to directors.

In the long-term the Malaysia Interest Rate is projected to trend around 250 percent in 2023 and 300 percent in 2024 according to our econometric models.

1 Key Policy Insights Oecd Economic Surveys Malaysia 2021 Oecd Ilibrary

Remuneration For Non Executive Directors In Malaysia Is On The Rise

Malaysia Election Results Parliamentary Seats 2018 Statista

1 Key Policy Insights Oecd Economic Surveys Malaysia 2021 Oecd Ilibrary

Education Implementation And Teams Resuscitation

1 Key Policy Insights Oecd Economic Surveys Malaysia 2021 Oecd Ilibrary

Frontiers Self Assessed Digital Competences Of Romanian Teachers During The Covid 19 Pandemic

Evaluation Of Constrained And Restrained Molecular Dynamics Simulation Methods For Predicting Skin Lipid Permeability Acs Omega

2018 Kidney Disease Improving Global Outcomes Kdigo Hepatitis C In Chronic Kidney Disease Guideline Implementation Asia Summit Conference Report Kidney International Reports

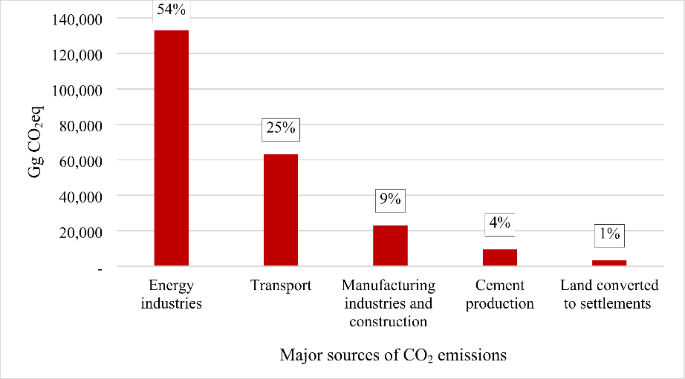

Dynamic Impacts Of Energy Use Agricultural Land Expansion And Deforestation On Co2 Emissions In Malaysia Springerlink

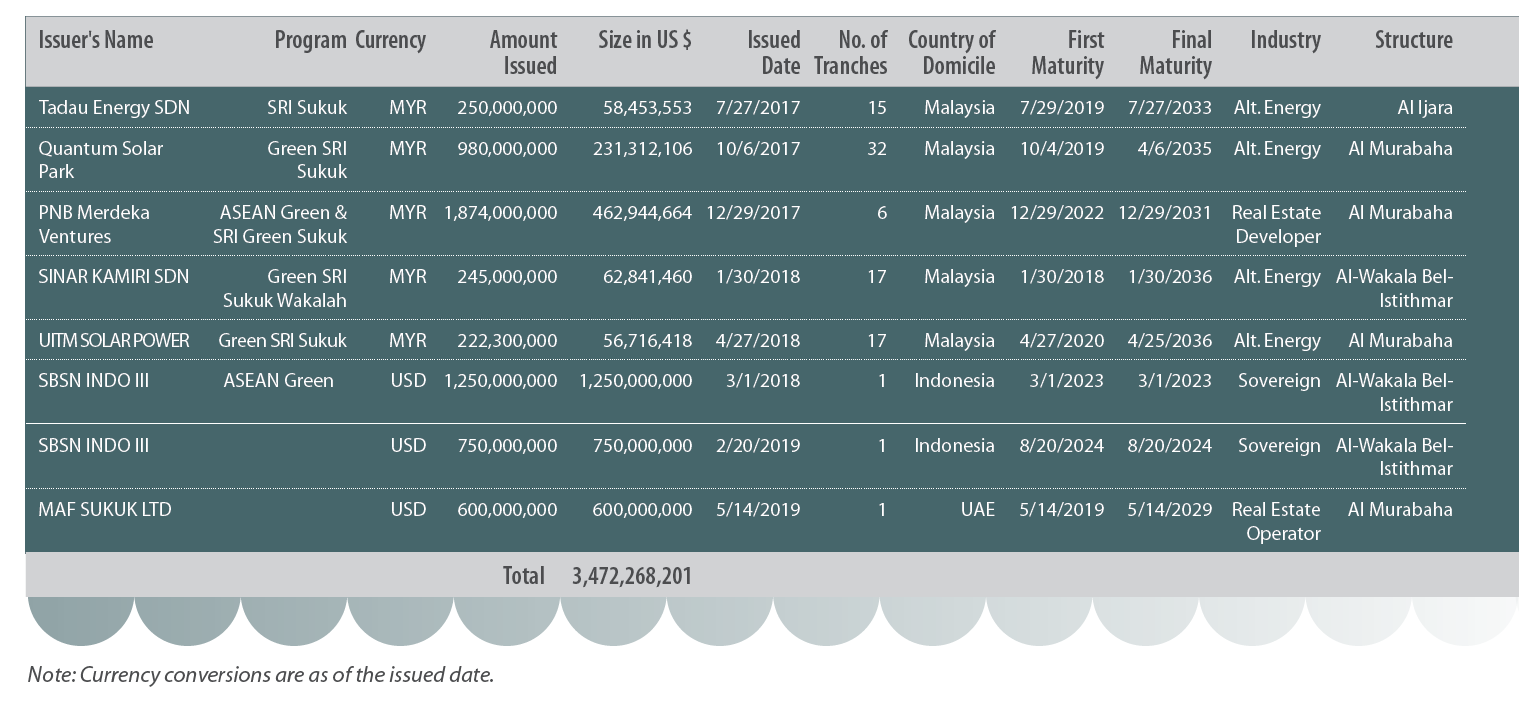

Green Sukuk A New Legacy For Green Sprouts Saturna Capital

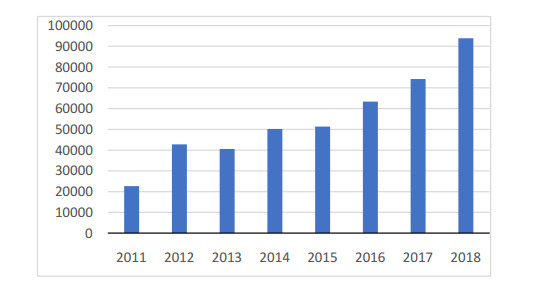

What Bank Specific And Macroeconomic Elements Influence Non Performing Loans In Bangladesh Evidence From Conventional And Islamic Banks

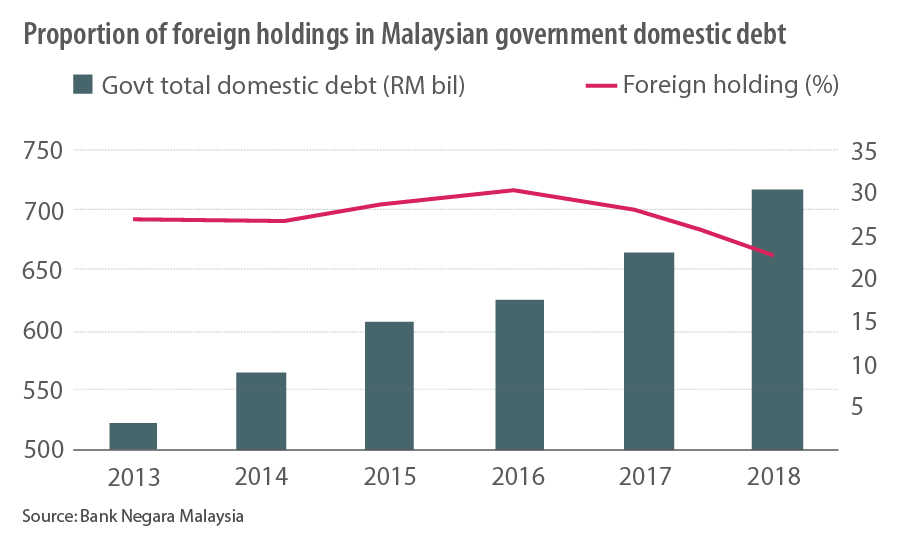

Green Sukuk A New Legacy For Green Sprouts Saturna Capital

Brazil Functional Literacy Rate Statista

Bank Lending Channel Of Monetary Policy Dynamic Panel Data Evidence From Sierra Leone

D C Gun Seizures Are Soaring But Charges Aren T Sticking The Washington Post